Customized Medicare Solutions: Medicare Supplement Plans Near Me

Customized Medicare Solutions: Medicare Supplement Plans Near Me

Blog Article

Just How Medicare Supplement Can Enhance Your Insurance Policy Protection Today

In today's complicated landscape of insurance alternatives, the role of Medicare supplements stands out as a crucial component in improving one's insurance coverage. As individuals browse the intricacies of healthcare plans and seek detailed protection, comprehending the subtleties of supplemental insurance coverage comes to be significantly essential. With an emphasis on bridging the spaces left by typical Medicare plans, these supplemental alternatives use a customized method to conference details needs. By exploring the benefits, insurance coverage alternatives, and cost considerations connected with Medicare supplements, people can make enlightened decisions that not just strengthen their insurance policy coverage but also offer a feeling of protection for the future.

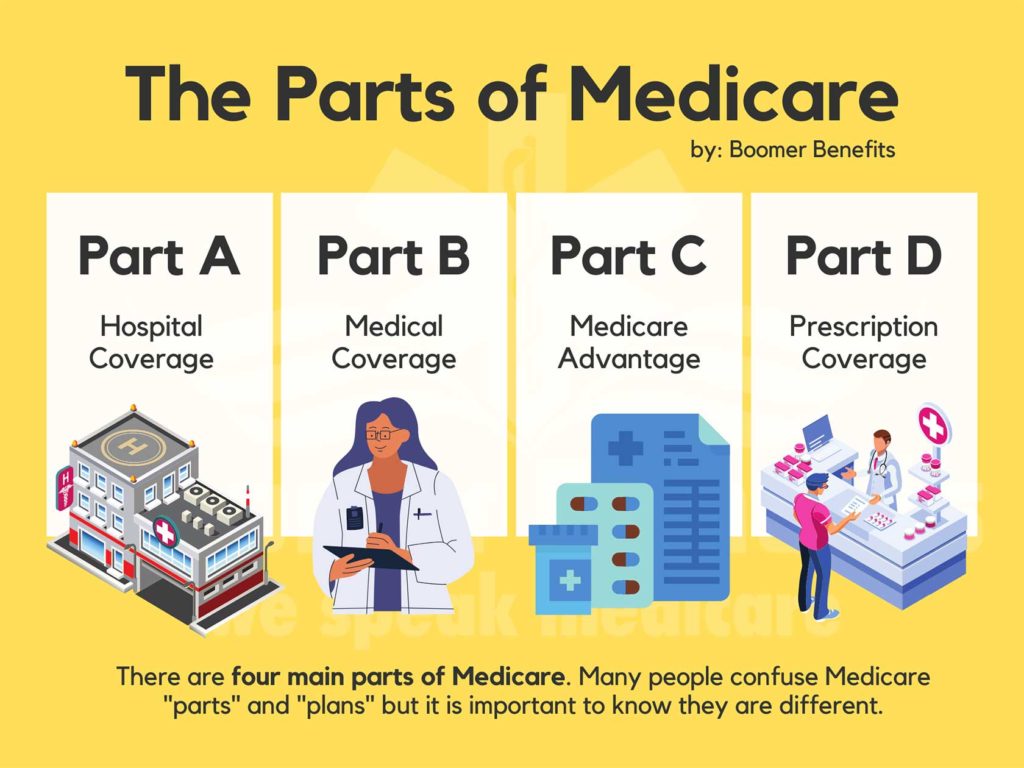

The Basics of Medicare Supplements

Medicare supplements, additionally known as Medigap plans, supply extra insurance coverage to fill the spaces left by initial Medicare. These additional strategies are supplied by private insurer and are developed to cover expenditures such as copayments, coinsurance, and deductibles that are not totally covered by Medicare Part A and Part B. It's important to keep in mind that Medigap strategies can not be utilized as standalone plans but work along with initial Medicare.

One trick aspect of Medicare supplements is that they are standardized across the majority of states, offering the same basic benefits regardless of the insurance coverage copyright. There are 10 different Medigap plans identified A with N, each providing a different level of insurance coverage. As an example, Plan F is among one of the most detailed alternatives, covering nearly all out-of-pocket prices, while various other strategies might offer more limited coverage at a reduced costs.

Comprehending the basics of Medicare supplements is essential for individuals coming close to Medicare qualification that desire to improve their insurance coverage and reduce possible monetary concerns associated with healthcare expenses.

Comprehending Insurance Coverage Options

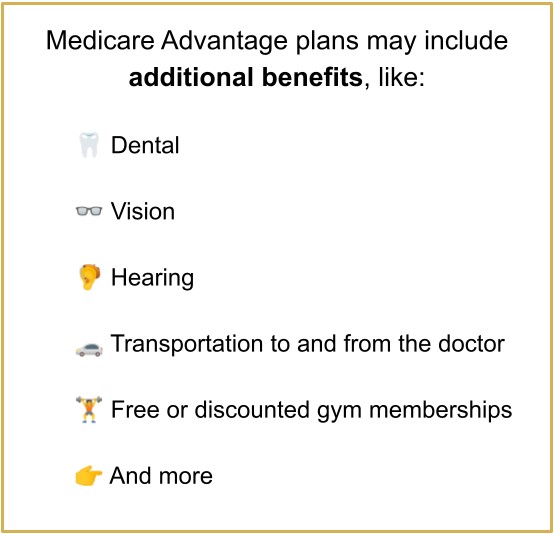

When taking into consideration Medicare Supplement intends, it is critical to comprehend the different protection options to guarantee extensive insurance protection. Medicare Supplement intends, also recognized as Medigap plans, are standard across many states and labeled with letters from A to N, each offering varying degrees of insurance coverage - Medicare Supplement plans near me. In addition, some plans may provide protection for solutions not included in Original Medicare, such as emergency situation care during international traveling.

Benefits of Supplemental Plans

Furthermore, supplemental plans use a more comprehensive range of coverage options, including access to health care companies that might not approve Medicare assignment. Another advantage of additional plans is the ability to travel with peace of mind, as some strategies supply coverage for emergency clinical solutions while abroad. On the whole, the advantages of supplementary strategies contribute to a more extensive and tailored approach to healthcare coverage, ensuring that people can obtain the treatment they require without encountering frustrating monetary concerns.

Expense Considerations and Savings

Offered the monetary safety and security and wider coverage options given by Resources supplementary strategies, an important aspect to consider is the price factors to consider and prospective savings they supply. While Medicare Supplement intends need a monthly costs along with the standard Medicare Component B premium, the benefits of minimized out-of-pocket expenses often surpass the added expenditure. When assessing the cost of additional plans, it is vital to compare costs, deductibles, copayments, and coinsurance across different strategy kinds to identify one of the most economical option based upon individual medical care needs.

By choosing a Medicare Supplement strategy that covers a greater percent of healthcare expenses, individuals can minimize unforeseen expenses and budget plan extra properly for clinical care. Ultimately, investing in a Medicare Supplement strategy can use beneficial economic protection and peace of mind for beneficiaries seeking extensive protection.

Making the Right Selection

With a range of plans available, it about his is crucial to analyze elements such as coverage choices, premiums, out-of-pocket expenses, service provider networks, and overall worth. Furthermore, assessing your spending plan restrictions and contrasting premium costs amongst different strategies can help ensure that you pick a plan that is inexpensive in the lengthy term.

Final Thought

Report this page